Increasing biosimilar availability and adoption is delivering on the fundamental promise of reducing healthcare costs for payers, employers and patients. Take a deeper dive into the latest data in the ninth edition of Amgen’s Biosimilar Trends Report, which provides a detailed look at the current state of the U.S. marketplace across oncology, inflammation and nephrology. It also addresses the role of regulators, policymakers and patients/advocacy groups in driving understanding, reimbursement, acceptance, and adoption of biosimilars in the healthcare system. This Report may help providers, payers, policymakers and others better understand the critical role biosimilars play in promoting a resilient U.S. healthcare system and how stakeholders can prepare for, and help drive, expansion of the U.S. marketplace with biosimilars.

Since 2015, 39 biosimilar products have been approved and 22 products have been launched.1 Since introduction, biosimilars have rapidly grown in adoption and now see significant share in the majority of therapeutic areas where they have been introduced.2 The U.S. marketplace is poised to see further growth in biosimilars approved to date, potentially driving new biosimilar development in the years to come. This additional competition may contribute to significant savings for the healthcare system, that can be deployed to newer, innovative treatments.3

Read key sections in the full report by using the links below (opens the full report PDF in a new window).

Dive Into the Report

Considerations for Stakeholders

Trend Highlights

![]()

The average sales price (ASP) is declining for both reference products and biosimilars.

![]()

In the U.S., the cumulative reduction in drug spend for classes with biosimilar competition is estimated to have been $21 billion over the past 6 years.4

![]()

The next few years will likely see several advancements, including expansion of biosimilars into pharmacy benefit reimbursement and biosimilars entering more classes, as well as additional approvals and launches of interchangeable biosimilars in the U.S.

![]()

Current U.S. regulatory standards for developing and approving biosimilars are scientifically appropriate to protect patient safety and support provider and payer confidence.

![]()

Essential components of provider and patient use of biosimilars include addressing the clinical, economic, and operational considerations relevant to adoption as well as payer coverage.

![]()

Competitive mechanisms are in place to support biosimilar uptake.

There was a dramatic increase in biosimilar launches from 2018 to 2020 compared to prior years.5 The slowdown of biosimilar approvals in 2020 and 2021 was likely due to several factors, some of which were pandemic related. Over the next few years, the marketplace with biosimilars should recover from this decline in activity, with new approvals and launches expected to increase to pre-2020 rates.

Number of Approved and Launched Biosimilars in the U.S., per Year

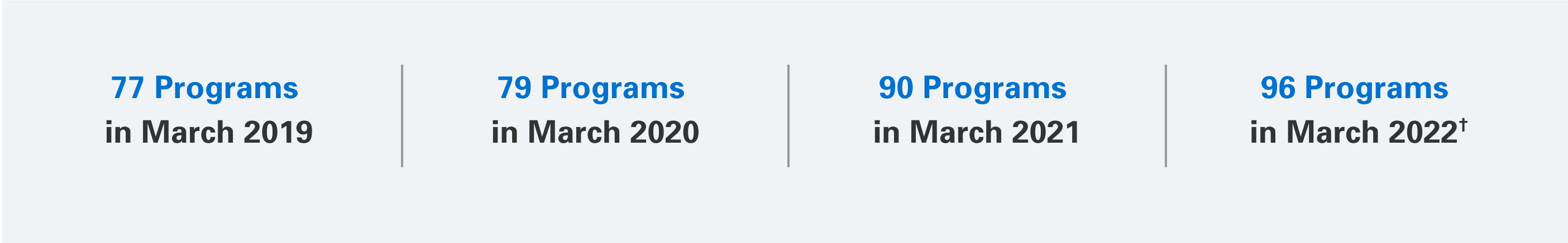

Although there was an overall decline in the number of approvals during the 2020 to 2021 timeframe, the number of development programs that are participating in the FDA’s Biosimilar Development Program has continued to rise.

Key: BLA – Biologics License Application; FDA – Food and Drug Administration; US – United States.

*2022 totals include latest available information (January to July 2022).

†Program totals reflect latest available data.

Note: SEMGLEE® (insulin glargine-yfgn) was approved by the FDA in June 2020 with a stand-alone BLA. TheFDA subsequently approved SEMGLEE as an interchangeable biosimilar in July 2021.

Sources: Xcenda 2022, FDA-Track Biosimilars Dashboard2022, FDAInterchangeable2021, CDER2020

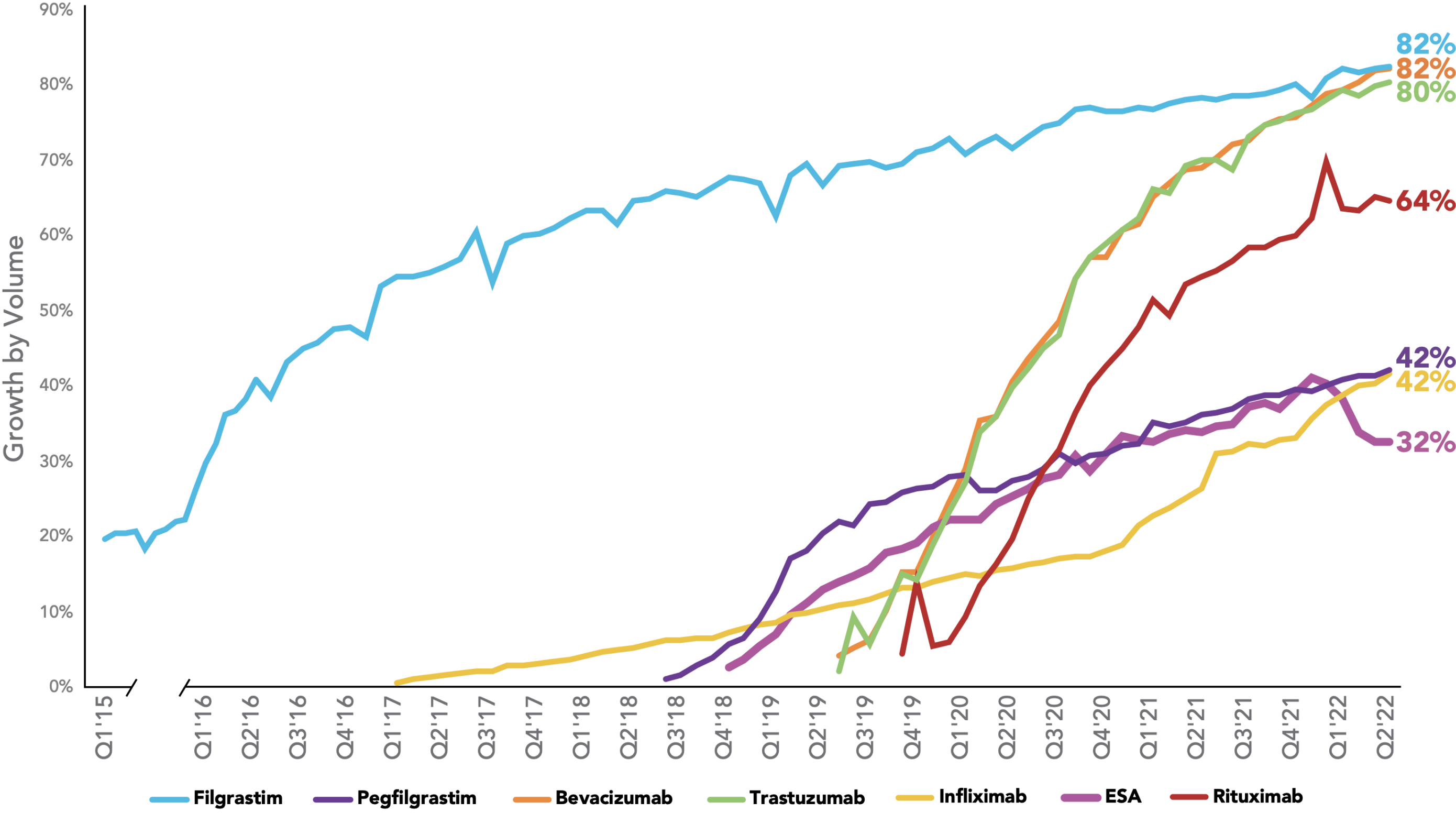

The rate of biosimilar uptake is generally increasing over time, with significant share gained in the majority of therapeutic areas where biosimilars have been introduced. For therapeutic areas with biosimilars launched in the last three years, the average share was 75%. For therapeutic areas with biosimilars launched prior to 2019, the average share after three years was 39%.

Biosimilars Uptake Curve

Key: ESA – erythropoiesis-stimulating agent.

Source: OBU Customer Data Pack Weekly (IQVIA DDD + Chargeback).

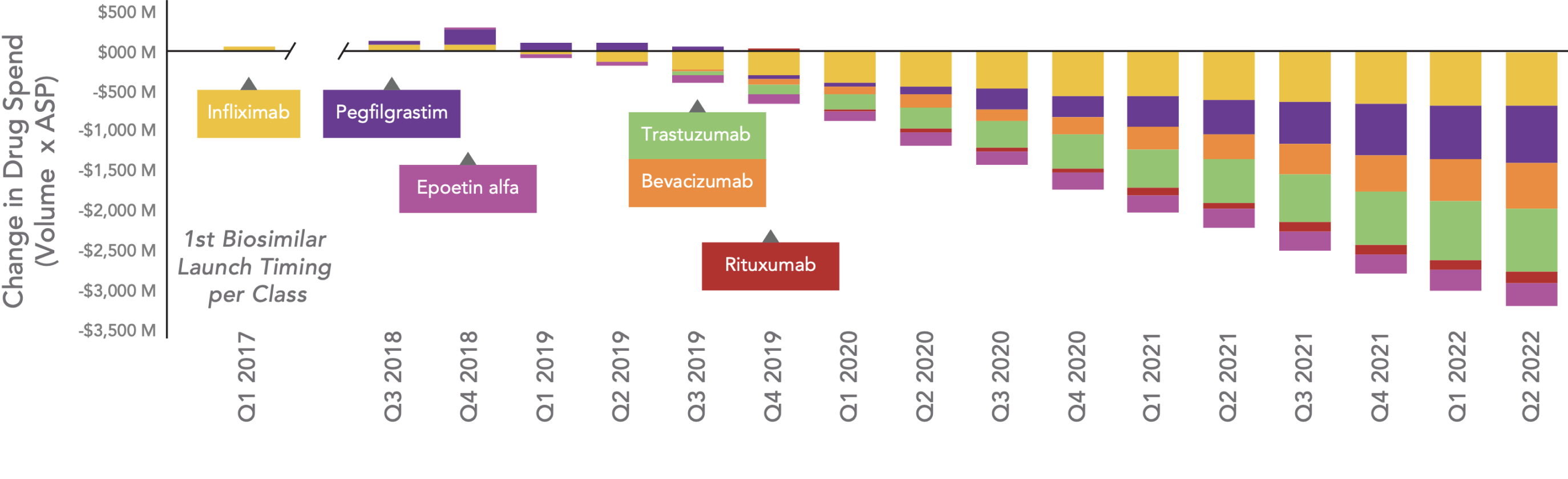

Beginning in Q1 2019, drug spending for most classes continues to decrease. In the U.S., the cumulative savings in drug spend for classes with biosimilar competition is estimated to have been $21 billion over the past 6 years. This trend seems to be continuing, and in Q2 2022 alone, savings in drug spend are estimated to be $3.2 billion.

Estimated Change in Total Drug Spend After Biosimilar Competition

Key: ASP – average sales price.

Note: Filgrastim is excluded from figure because the first biosimilar in its class was launched in 2013 and data are not available prior to Q2 2016 for normalized units. The quarterly drug spend for each product is estimated as: Drug spend=ASPxNormalized unit volume. The estimated spend for the reference product (after biosimilar launch) is trended out based on historical spend for the reference product before biosimilar launch.

Sources: AnalySource, Integrated Weekly Sales Data (IQVIA DDD + Chargeback).

The EU and U.S. markets dominate the use of biosimilar medicines with 90% cumulative use (by sales); other countries have yet to harness the potential benefits of biosimilars.6

Globally, established regulatory pathways and associated standards continue to vary. While some countries have specific pathways for approving biosimilars and rigorous regulatory standards, others have yet to develop laws or regulations specific to biosimilars or are still in the process of implementing a pathway based on their laws and regulations. Adherence to globally accepted regulatory standards, such as the 2022 Guidelines on the Evaluation of Biosimilars, is fundamental to assuring patients and the medical community that approved biosimilar products are safe and efficacious and ensuring that adverse events can be accurately tracked and identified.7

Growth seems to be on the horizon for the marketplace with biosimilars, both in terms of breadth and depth. As of Q2 2022, the FDA lists 96 proposed biosimilar products enrolled in the FDA’s Biosimilar Development Program, an increase of more than 70% since October 2015.8

Over the next few years, the growing number of biosimilars will likely lead to an evolution in the U.S. marketplace with biosimilars. These changes are likely to cement the role of biosimilars as viable and integral U.S. treatment options. Biosimilars will find new audiences in different prescriber specialties, pharmacists, payers, and patients. These developments may change the patient support program landscape, interactions at the pharmacy counter, and product-administration devices.

Amgen's 2022 Biosimilar Trends Report is a point-in-time overview of key trends in the US biosimilars marketplace, and it is intended to be a resource to help stakeholders better understand the current and future state of the biosimilars marketplace, and key considerations related to the evolving biosimilars landscape. The information provided in Amgen's 2022 Biosimilar Trends Report is for background and informational purposes only and is not intended to promote Amgen's products or any other products.

References: 1. Xcenda 2022 2. DOF Market Trends 2022 3. Pettit 2018 4. DOF Biosimilars Spend Analysis 2022 5. Xcenda 2022 6. International Generic and Biosimilar Medicines Association 2021 7. WHO 2022 8. FDA-TRACK 2022